Publications

Filter by type:

Crisis, Country, and Party Lines: Politicians' Misinformation Behaviour and Public Engagement

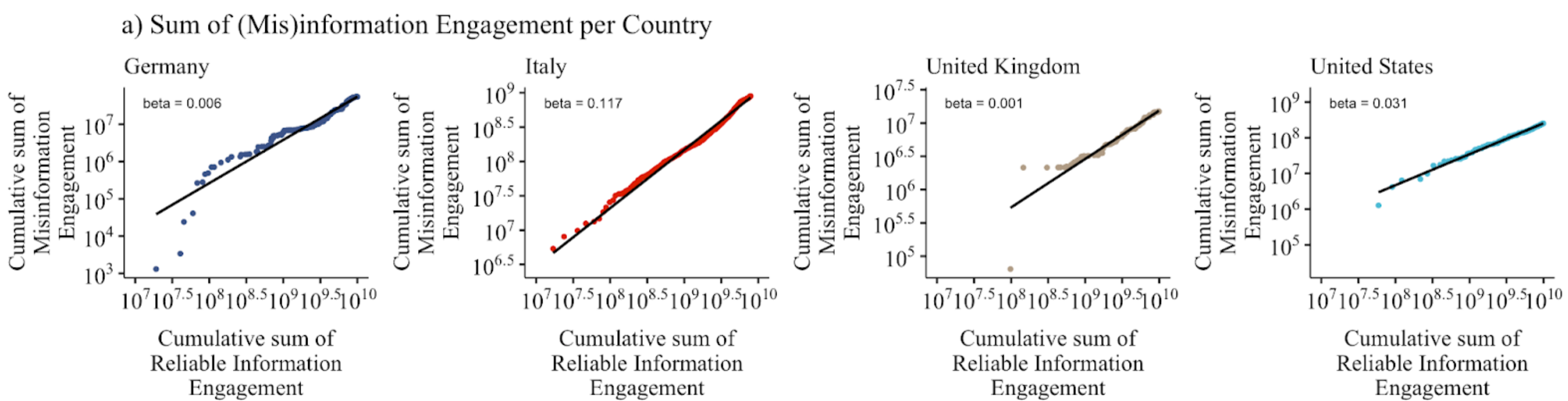

This study examines the sharing of misinformation and public engagement on X (formerly Twitter) by politicians in Germany, Italy, the UK, and the US during 2020-2021...

2025

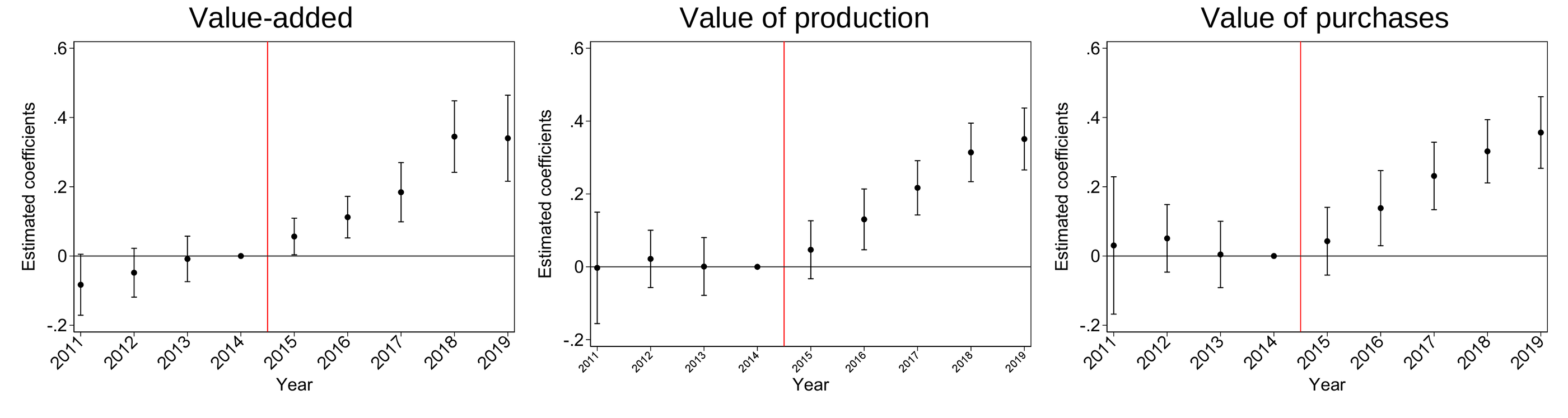

Inverting the chain? VAT collection regimes and tax compliance

The Reverse Charge (RC) mechanism in VAT shifts tax responsibility to retailers and maintains third-party reporting, aiming to reduce VAT tax gaps...

2024

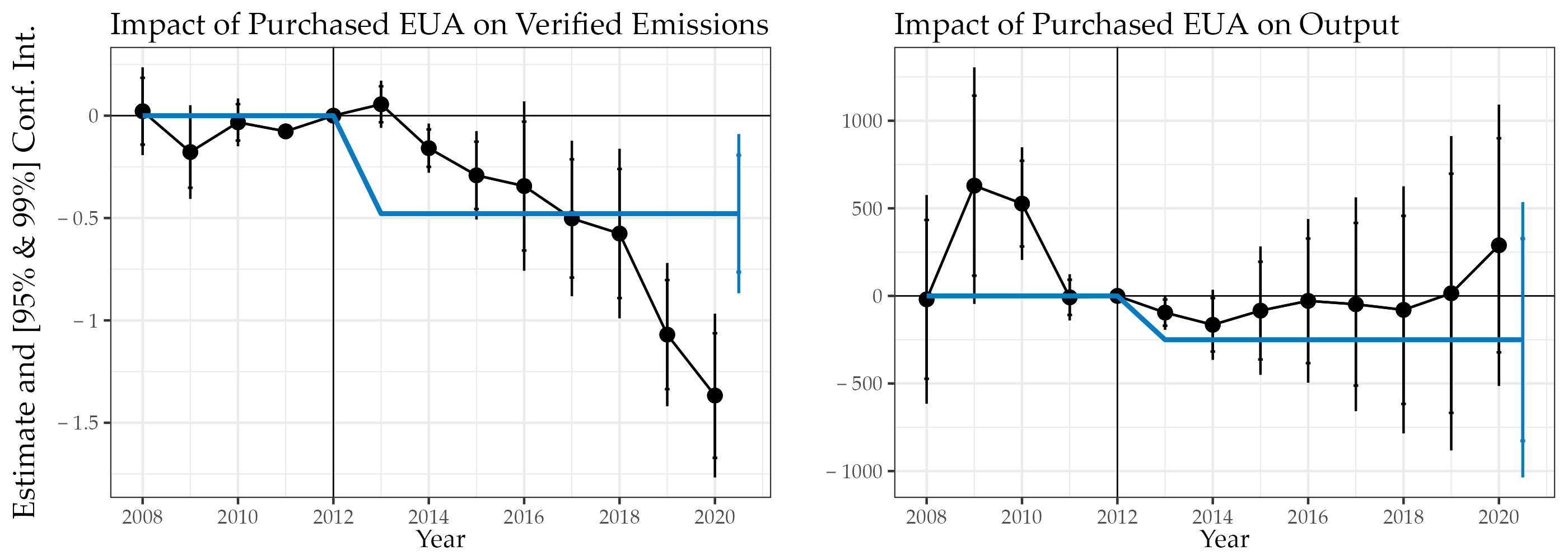

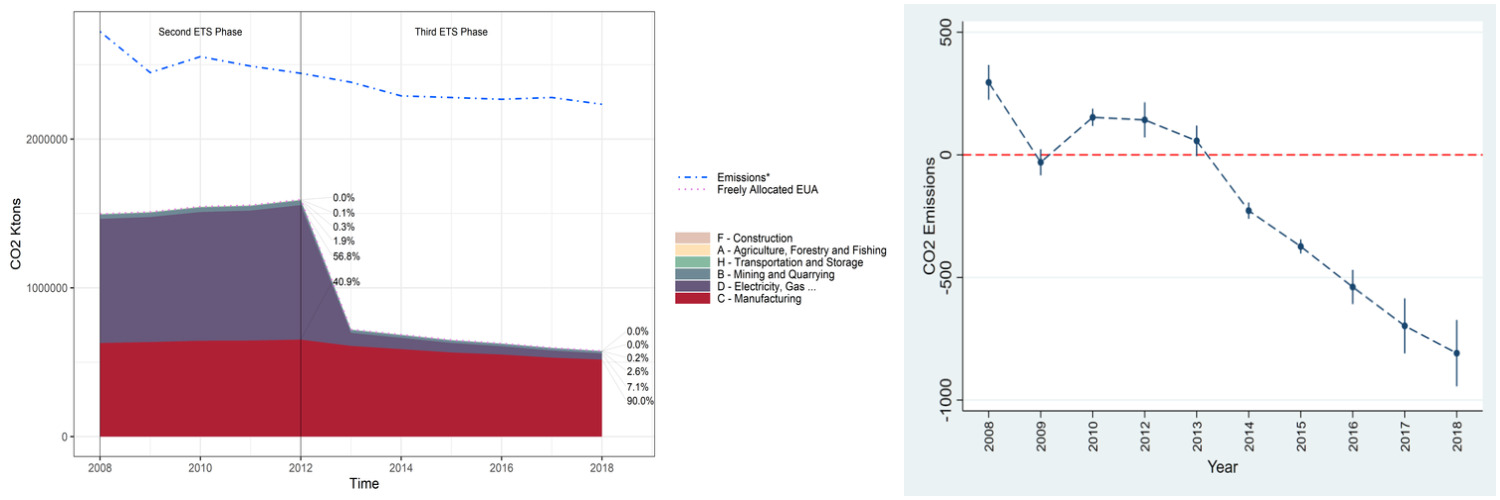

Third Time's a Charm? Assessing the Impact of the Third Phase of the EU ETS on CO2 Emissions and Performance

The EU Emissions Trading System (ETS) is the largest cap-and-trade scheme for CO2 emissions. This study evaluates the impact of Phase 3’s increased stringency, which significantly reduced the number of freely allocated emissions permits. Our analysis shows that purchasing additional EU Allowances (EUA) had a substantial impact on emissions reduction, with a conservative estimate of 422 MtCO2-eq, 4.3%-3.0% of EU ETS emissions in Phases 2 and 3 respectively. Derogation 10c, which allowed lower-income Member States to continue free EUA allocation, had a detrimental impact on emission reduction, leading to an increase in emissions of about half a ton for each additional allowance bought (instead of the decrease of half a ton observed in other countries). Our analysis finds no negative impact on output, capital productivity, or labour productivity. Our results support the reduction of free EUA allocation and tightening of regulations in Phase 4 of the EU ETS.

Third Time’s a Charm? Assessing the Impact of the Third Phase of the EU ETS on CO2 Emissions and Performance,2023

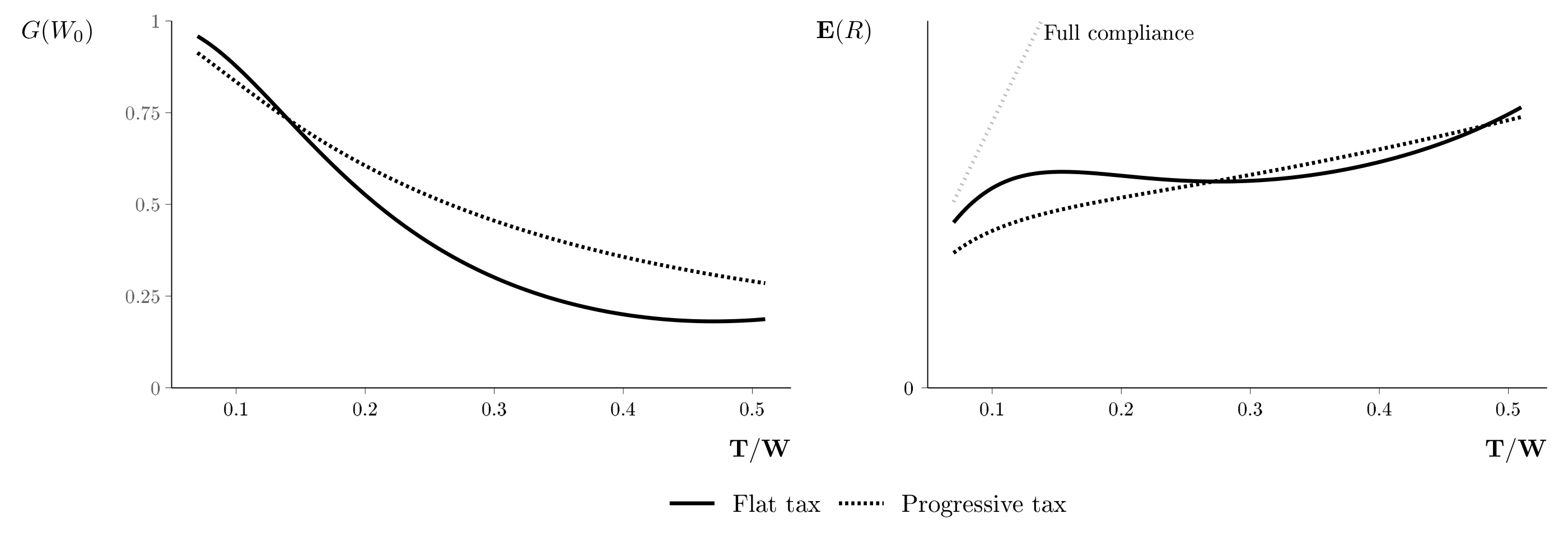

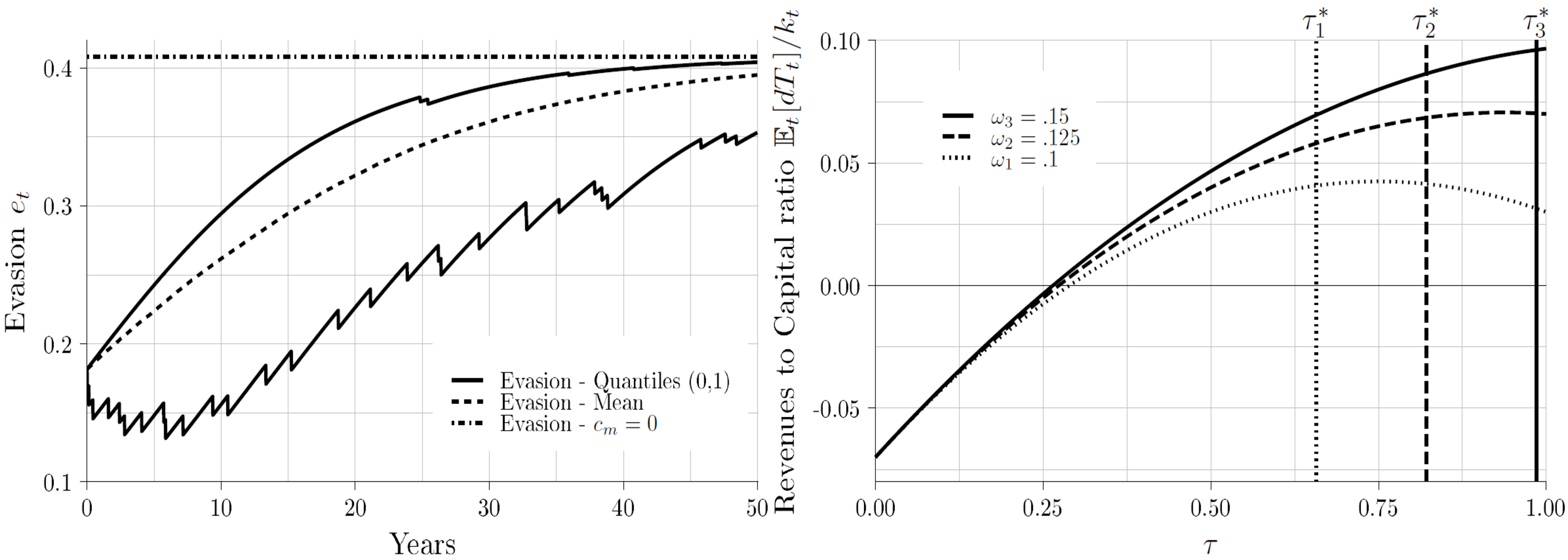

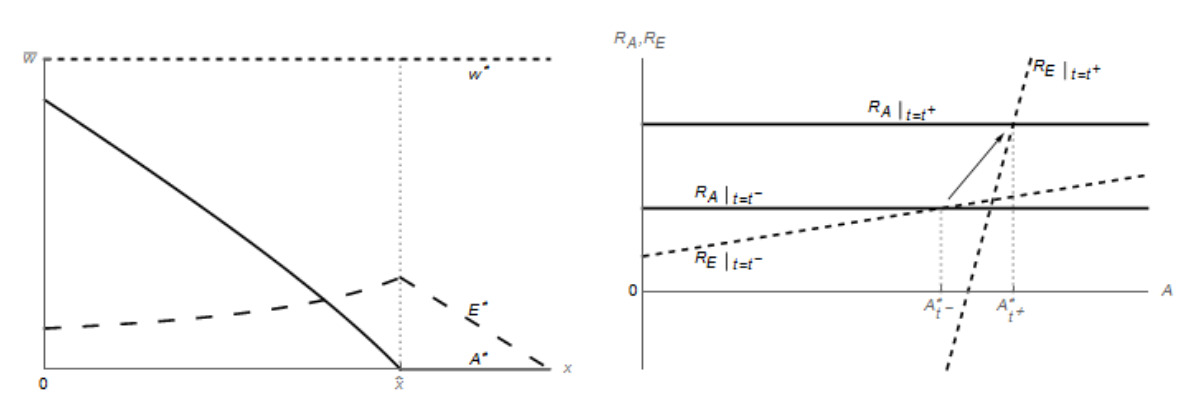

Marketed Tax Avoidance: An Economic Analysis

In a model that allows for both demand- and supply-side considerations, we examine the consequences, for the structure of income tax, and for tax authority anti-avoidance efforts, of the growth of mass-marketed tax avoidance schemes occurred in recent years.

The Scandinavian Journal of Economics,

2023

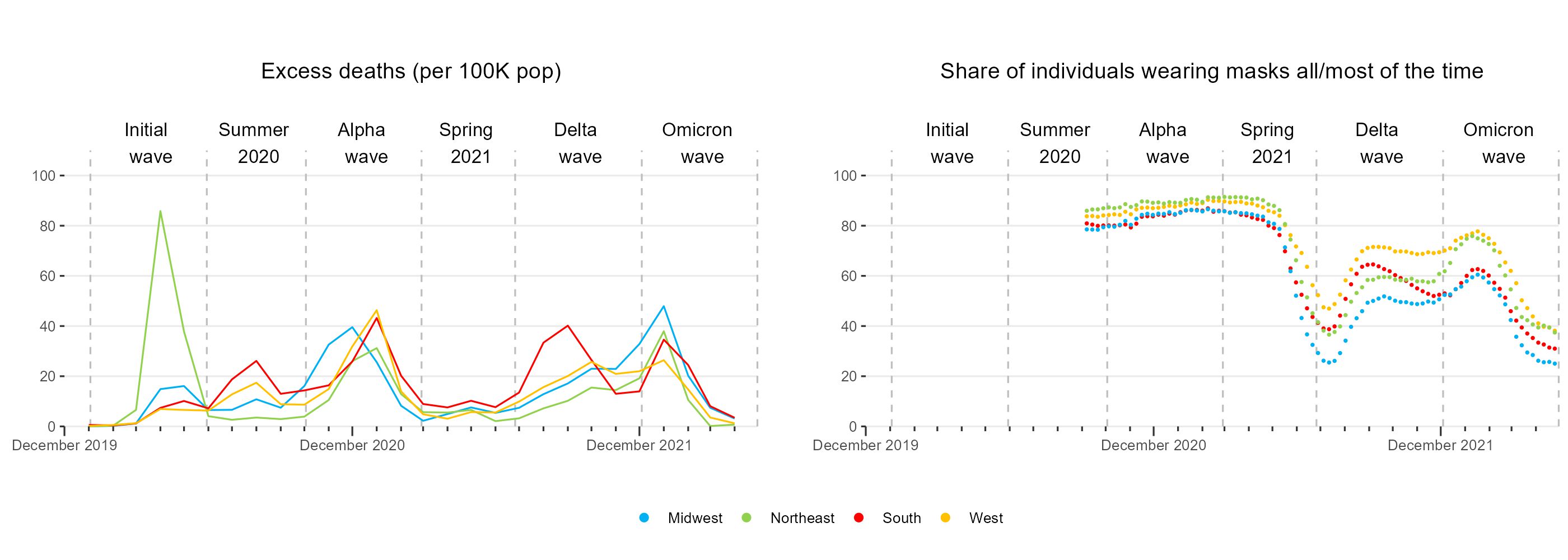

Differential COVID-19 mortality in the United States: Patterns, causes and policy implications

In 2021, a “two Americas” narrative emerged: one with high demand for COVID-19 vaccines and a second with widespread vaccine hesitancy and opposition to mask mandates. In this study, we investigate the dynamic of excess mortality from the start of the pandemic to April 2022 at the regional level. If every region had had the lowest mortality rate in that period, more than 418,763 COVID-19 deaths would have been “avoided”. These results seem to be driven by differentials in NPI adoption and vaccination. Our study illustrates the significance of excess mortality measures as part of a comprehensive surveillance system and the importance of population-based COVID-19 policies, including mask adoption.

2022

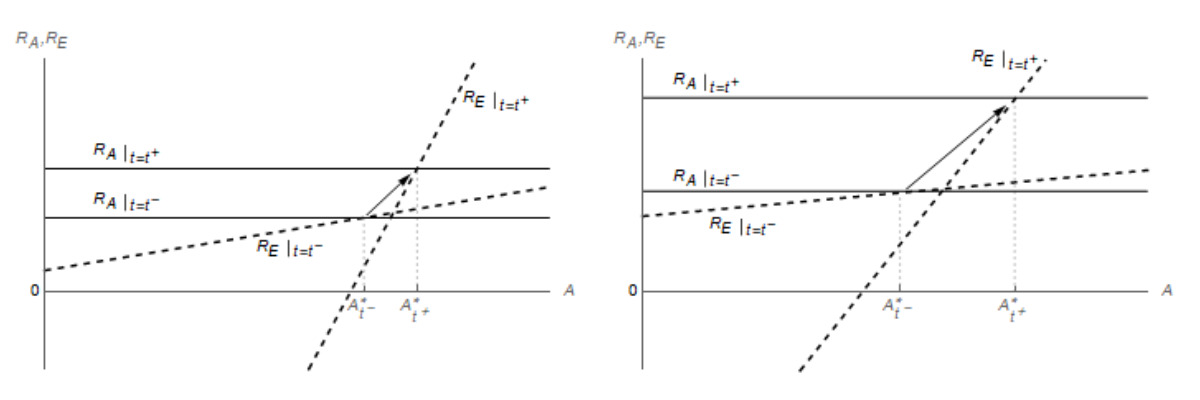

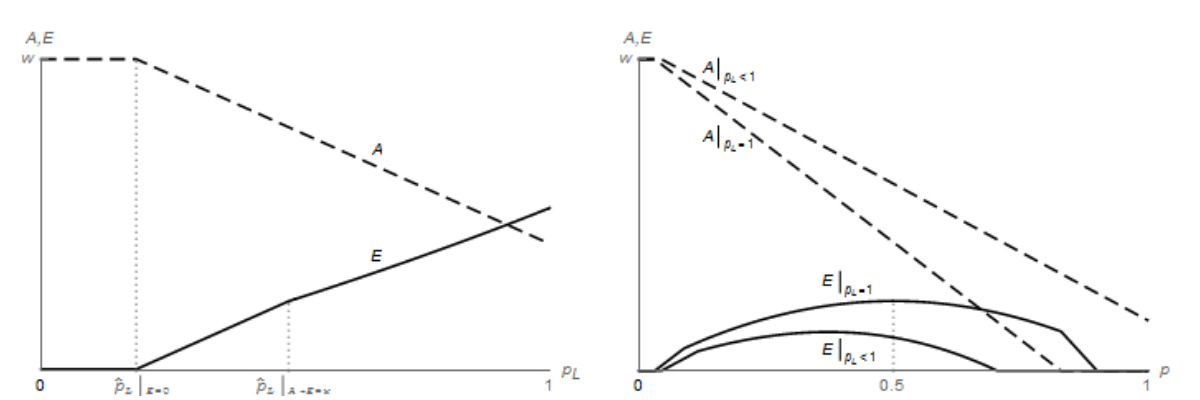

Tax Avoidance and Evasion in a Dynamic Setting

We study tax avoidance and tax evasion in a intertemporal setting. Our model shows that non-compliance behaviour may result in a Laffer curve for fiscal revenues and that the revenue-maximizing tax rate is lower the more effective is avoidance at shielding taxpayers from fines.

Journal of Economic Behavior & Organization,

2022

Improving the quality of public spending in Europe

This EPRS study looks at whether, and under what conditions, greater effectiveness could be achieved in overall public spending at all levels of the European Union through greater pooling of resources at European level. It suggests that added value can be realised in public spending, through efficiency gains and lower administrative costs, delivered by and through the EU budget, usually with corresponding savings to national budgets. The study provides a methodology for assessing the ‘waste rate’ in overlapping national spending and analyses four policy areas, with the potential to realise gains of around 180 billion euros.

Study for the European Parliament,

2020

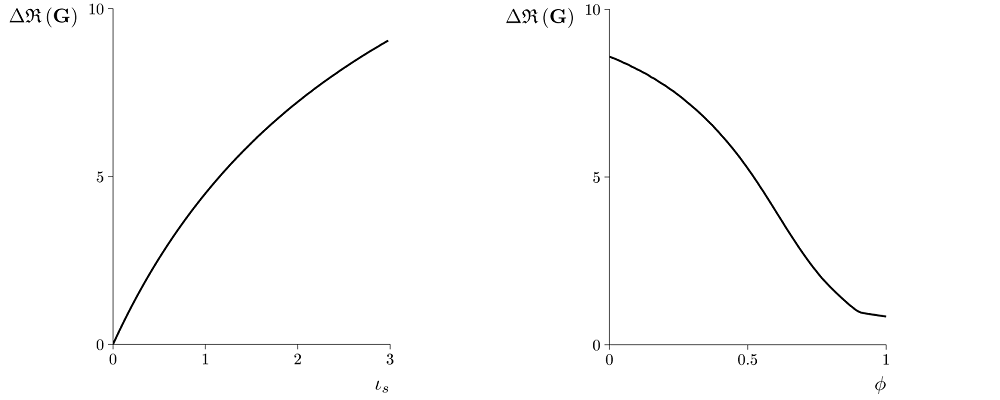

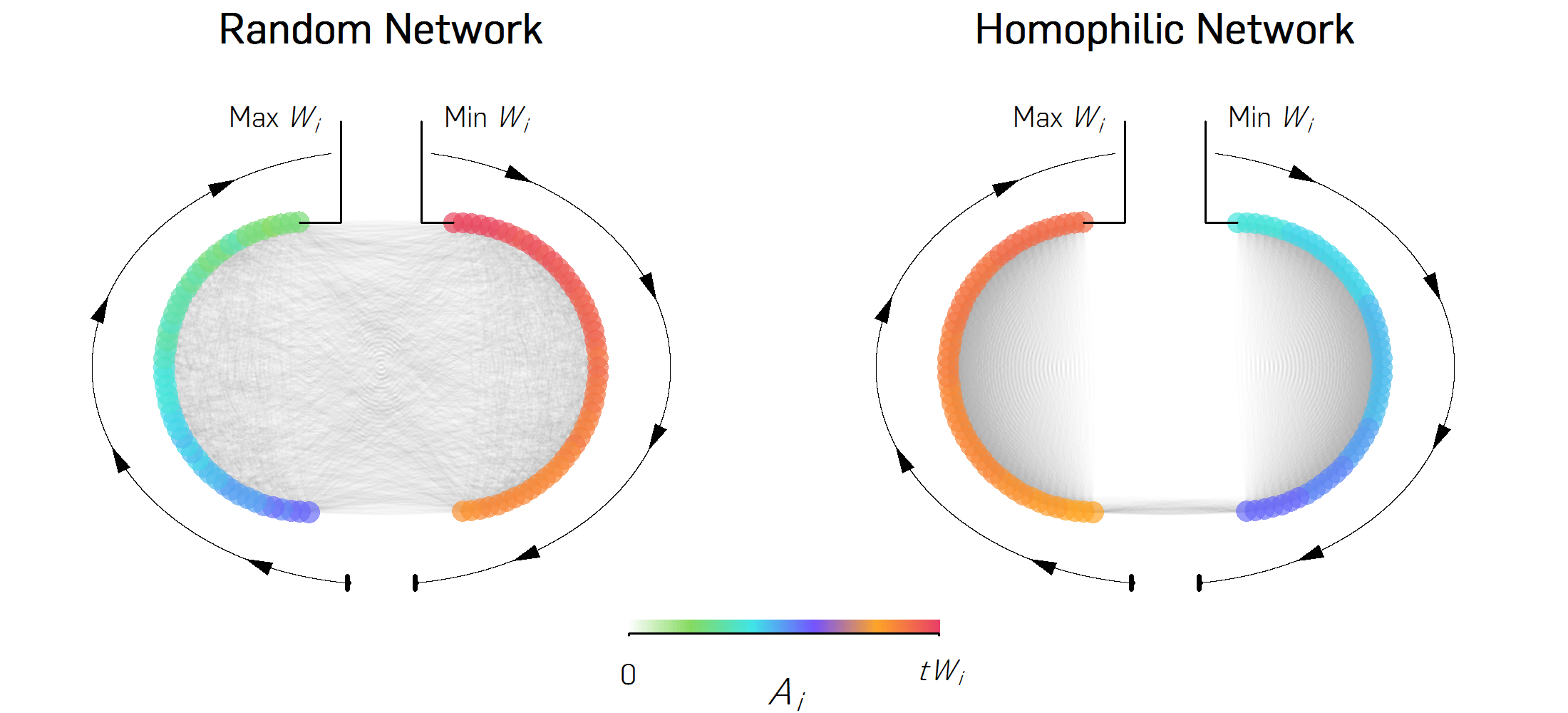

Tax Evasion on a Social Network

In this contribution it is investigated the impact of social interaction on optimal evasion and assessed the audit revenue gains that may be obtained by targeting audit using social network information.

Journal of Economic Behavior & Organization,

2020

Tax avoidance and optimal income tax enforcement

This paper extends the analysis undertook in Optimal Income Tax Enforcement in the Presence of Tax Avoidance

In Journal of Tax Administration,

2017

Optimal Income Tax Enforcement in the Presence of Tax Avoidance

An analysis of optimal tax enforcement policy when taxpayer may engage in both avoidance and evasion.

In The Routledge Companion to Tax Avoidance Research,

2017

Tax Avoidance on a Social Network

In this contribution it is studied the optimal avoidance decision when taxpayers evaluate their utility relative to a benchmark or “reference” level of income.

Working Paper,

2017

Income tax avoidance and evasion: A narrow bracketing approach

A model that investigates how recent Behavioural Economics findings affect the taxpayer’s joint decision to avoid and/or evade

In Public Finance Review,

2016

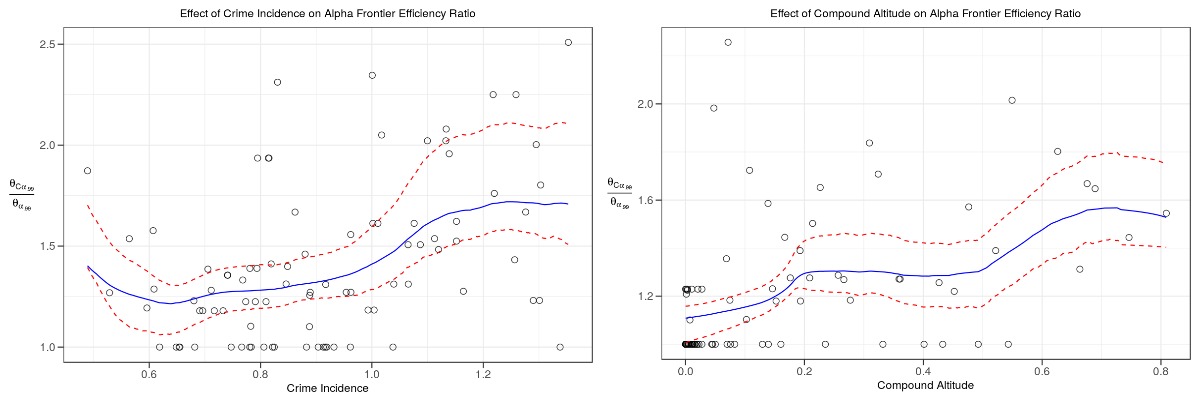

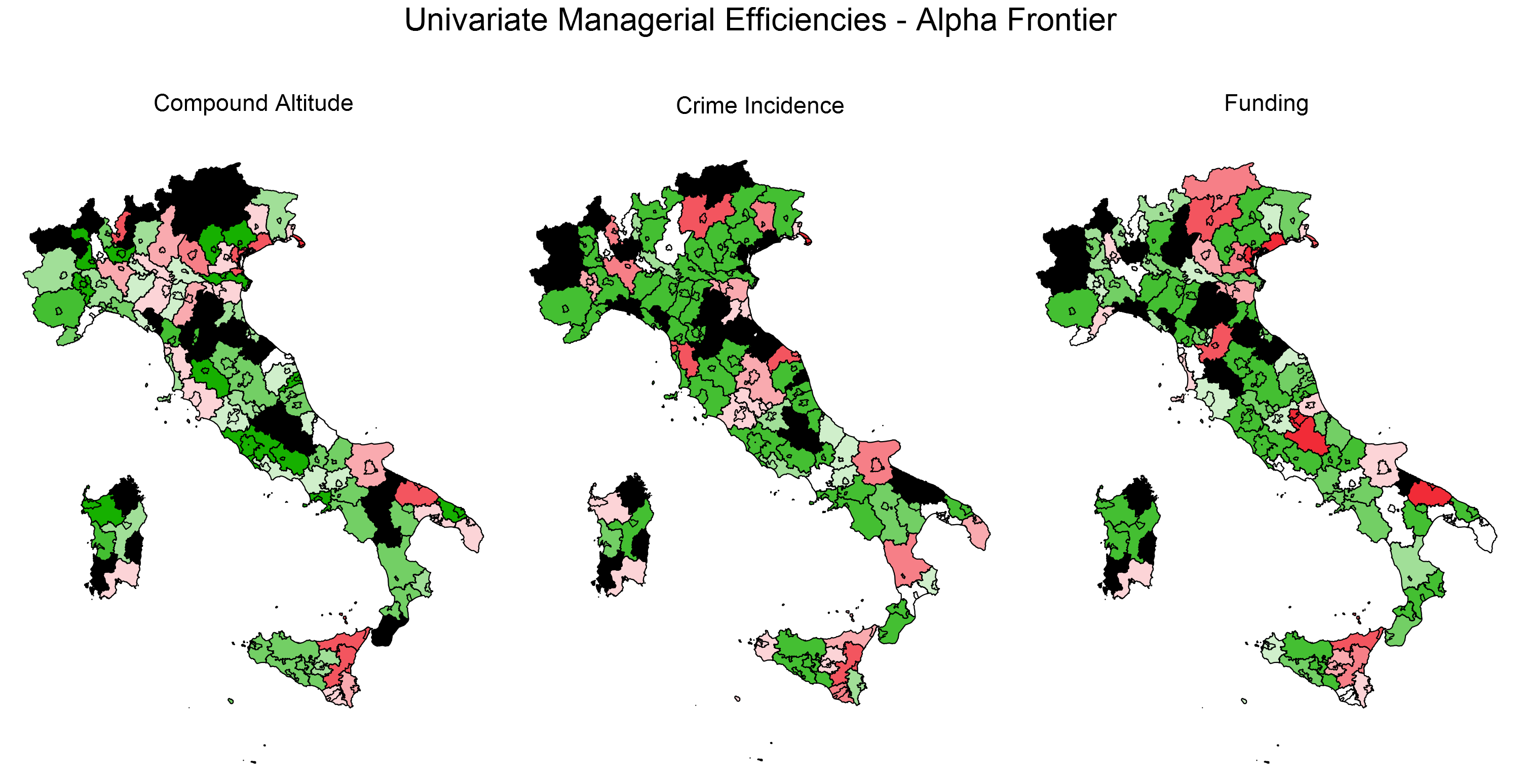

Italian municipalities efficiency: A conditional frontier model approach

The article provides an assessment of the performances of Italian local government using conditional frontier models.

Working Paper,

2016